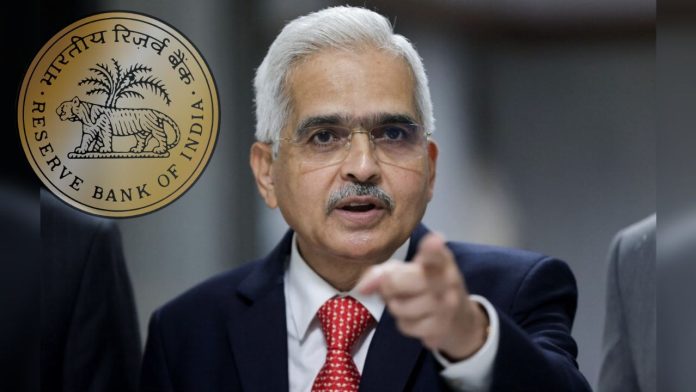

The Central Reserve Bank (RBI) has prohibited transactions under the Liberalized Remittance Scheme (LRS) of SBM Bank (India) Limited with immediate effect. This ban will remain in force till further orders from the central bank.

What did RBI say?

According to the Reserve Bank’s notification, RBI has taken this action while exercising its powers under Section 35A and 36(1)(a) of the Banking Regulation Act, 1949.According to RBI, this action on SBM Bank (India) Limited is based on certain concerns. However, the central bank did not elaborate on those concerns.

What is LRS scheme?

Under this scheme launched by the Central Reserve Bank, the residents of the country can freely send funds abroad up to $ 250,000 per financial year. The Reserve Bank increases or decreases this limit from time to time.

Explain that SBM Bank is a subsidiary of Mauritius-based SBM Holdings. It is a financial services company. The bank offers a range of financial products and services including deposits, loans, trade finance and cards. SBM Bank started operations on 1 December 2018 after obtaining a banking license from RBI. The bank has a network of 11 branches across the country.